Donald Trump’s new tariff policies are creating unexpected trouble for his energy plans. The tariffs, meant to help American factories, have caused oil prices to drop and energy stocks to fall. OPEC+ is also increasing oil supply, pushing prices even lower. These economic shifts might hurt the U.S. energy sector that Trump promised to strengthen. The question now facing markets: can Trump’s vision of “energy dominance” survive the very trade barriers he’s building?

While Donald Trump’s aggressive tariff policies aimed to protect American manufacturers, they’ve created unexpected ripples through the U.S. energy sector. Despite carveouts designed to shield energy exports, the broader economic impacts have sent crude oil prices tumbling more than 6% following tariff announcements.

Trump’s tariff shield couldn’t prevent economic tremors from rocking U.S. energy markets, sending crude prices plummeting.

The market reaction shows how interconnected global energy markets remain, regardless of protective measures. OPEC+ plans to increase oil supply have further complicated matters, putting additional downward pressure on prices. U.S. oil and gas sector ETFs like XOP dropped 5% as investors processed the tariff news. Industry analysts are concerned that long-term economic effects could severely impact energy markets despite current exemptions for oil and gas.

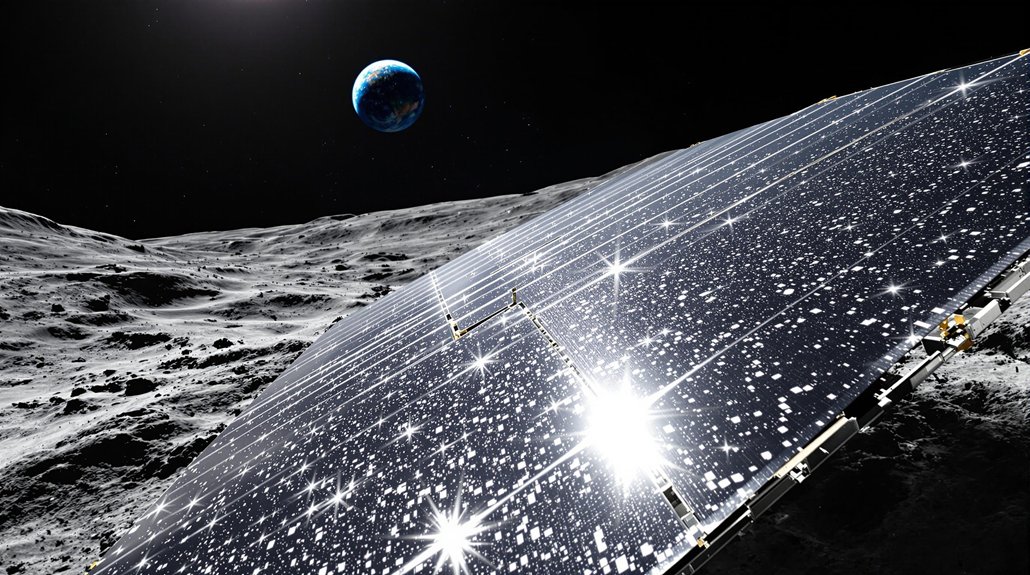

During his term, Trump formed the National Energy Dominance Council to cut red tape and boost American energy production. These efforts helped the U.S. become a net energy exporter for the first time in nearly 70 years. The administration focused on strengthening domestic supply chains and promoting American energy exports worldwide. This approach stands in contrast to the global trend where renewable sources power nearly 30% of electricity generation worldwide.

Trump’s environmental deregulation played a key role in this strategy. His policies rolled back Obama-era rules, opening up opportunities for what he claimed was $50 trillion worth of energy production. Pipeline projects like Dakota Access were approved, and compliance costs for energy companies were reduced.

These efforts yielded remarkable results. The U.S. became the world’s largest oil and natural gas producer, and carbon emissions reached their lowest level in 25 years. However, the recent tariff announcements have revealed contradictions in this approach.

Tariffs create a fundamental tension between raising government revenue and boosting domestic manufacturing. If companies considerably reduce imports in response to tariffs, the expected revenue gains may not materialize. Critics also point out that tariffs affect different economic sectors unevenly. The conflicting goals of using tariffs as both a revenue source and a negotiating tool demonstrate a lack of consistent economic strategy.

Economists now predict that higher-than-expected tariffs will slow global growth, potentially reducing energy demand. This puts Trump’s energy dominance vision at risk, as U.S. exports depend on strong international markets. The tariff wall built to protect American industry might inadvertently weaken the energy empire Trump worked to build.