As Wyoming leads the nation in coal production, the state’s energy terrain is rapidly evolving with considerable growth across multiple sectors. The Cowboy State supplies about 40% of the nation’s coal while also expanding its renewable and nuclear fuel resources. Wind energy capacity has now surpassed 3,000 megawatts, with multiple utility-scale projects in operation across the state.

Wyoming’s uranium sector has seen remarkable growth, with production increasing by an astounding 653.5% year-over-year in the fourth quarter of 2024. This surge has positioned Wyoming as the third-largest uranium producer in the United States. Three in-situ recovery uranium mines have restarted operations: Lost Creek, Christensen Ranch, and Lance. These restarts were driven by higher uranium prices and new sales contracts.

Wyoming’s uranium production skyrocketed 653.5%, catapulting the state to third-largest producer nationwide as three mines resume operations amid favorable market conditions.

The Lost Creek mine received regulatory approval for expansion in May 2025, allowing for up to six new mine units. This mine is now licensed to produce 1.2 million pounds of yellowcake uranium annually. The approval process was expedited under Trump-era executive orders designed to speed up domestic energy project permitting.

The Battle Springs Formation aquifer exemption was a key part of this approval, designating the water source as unsuitable for future drinking water but available for mining operations. Regulators emphasized that this decision came after years of scientific, environmental, and technical review.

Wyoming’s diverse energy portfolio continues to support the state’s economy. Oil production averages about 260,000 barrels daily, ranking Wyoming among the top ten oil-producing states. Natural gas output has remained steady at approximately 1.5 trillion cubic feet annually. Ur-Energy’s CEO John Cash emphasized that these uranium projects will help diversify Wyoming’s tax base through expanded mineral production. Wyoming’s favorable regulatory environment has established the state as a business-friendly jurisdiction for mining companies seeking to develop uranium resources.

Despite uranium’s price volatility—peaking at $106 per pound in early 2024 before falling to $64.23 by March 2025—the sector’s expansion is bringing new revenue to Wyoming. State officials note that energy mineral royalties and sales considerably fund education, infrastructure, and government services.

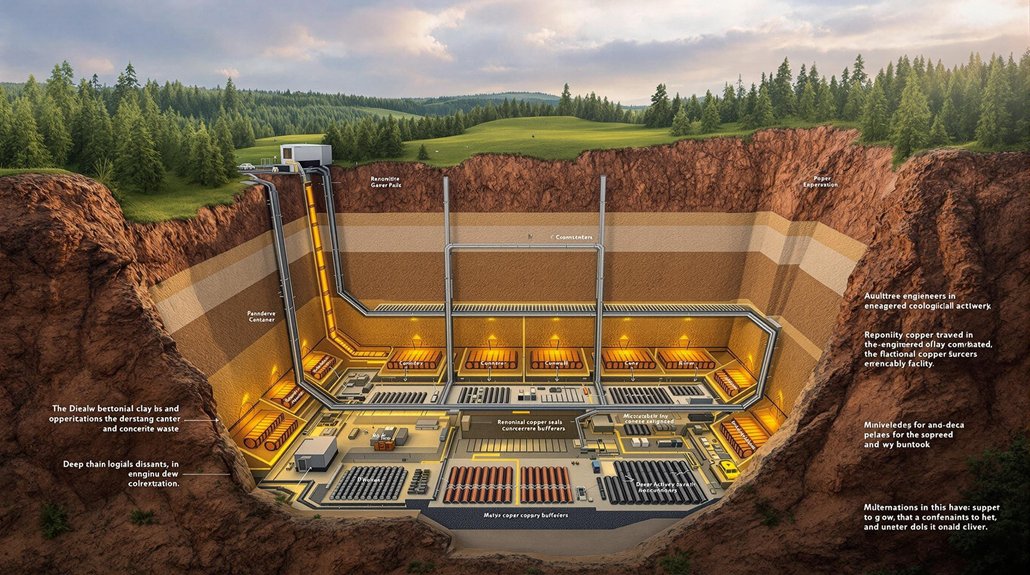

All active uranium mines use in-situ recovery methods, which cause less surface disturbance than conventional mining. While uranium mining expands, the state is also exploring geothermal energy development which offers 24/7 reliability unlike weather-dependent renewables.

References

- https://www.uwyo.edu/ser/research/centers-of-excellence/energy-regulation-policy/_files/crew-report-may-2025.pdf

- https://www.ans.org/news/2025-05-12/article-7016/epa-wyoming-approve-future-expansion-of-urenergys-lost-creek-mine/

- https://www.wsgs.wyo.gov/products/wsgs-2025-uranium-summary.pdf

- https://www.epa.gov/newsreleases/epa-state-approve-uranium-mining-project-wyoming-aquifer

- https://www.cruxinvestor.com/posts/wyoming-premier-mining-jurisdiction-for-uranium-miners-and-investors