While most Americans struggle with rising energy bills, Texas and 10 other states have launched a bombshell lawsuit against financial behemoths BlackRock, Vanguard, and State Street. The accusations? Forming a cartel to rig coal markets, slash energy supply, and jack up prices across the country. Not exactly your average Tuesday on Wall Street.

The lawsuit alleges these asset management titans used their massive stockholdings to pull strings at every major U.S. coal producer. Texas Attorney General claims their goal was brutal: cut coal output by more than half by 2030. Meanwhile, your electricity bill keeps climbing. Funny how that works.

According to the complaint, these financial giants announced joint commitments in 2021 to leverage their coal company shares for “green energy” goals. They reportedly used initiatives like Climate Action 100 and Net Zero Asset Managers to signal their collective intention to strangle coal production. Coordinated ESG strategies, information-sharing schemes—the whole nine yards.

Wall Street’s green power play: weaponizing trillion-dollar portfolios to quietly choke coal while claiming it’s just business.

The Wall Street giants aren’t taking this lying down. They’ve filed a joint motion to dismiss, calling the lawsuit “baseless.” Their defense? They only held small minority stakes in coal companies and couldn’t possibly control production decisions. Besides, U.S. coal output actually increased, not decreased. The motion also highlights that voting records show BlackRock and State Street actually opposed directors who attempted to reduce coal production. They also pointed out that deliberately tanking an industry you’re invested in makes zero financial sense. Fair point.

Critics of the lawsuit note that coal’s decline has been happening for decades thanks to cheaper natural gas and stricter regulations. The conspiracy theory, they say, ignores basic market realities. This shift toward renewable energy could significantly reduce the carbon footprint associated with electricity generation, similar to efforts by major tech companies to power their data centers. Any successful lawsuit could severely impact index funds, which currently hold nearly half of all net investment assets as of 2023.

The suit claims thousands of investors were deceived, thinking they were putting money into non-ESG funds. If successful, this case could throw common asset management practices into chaos.

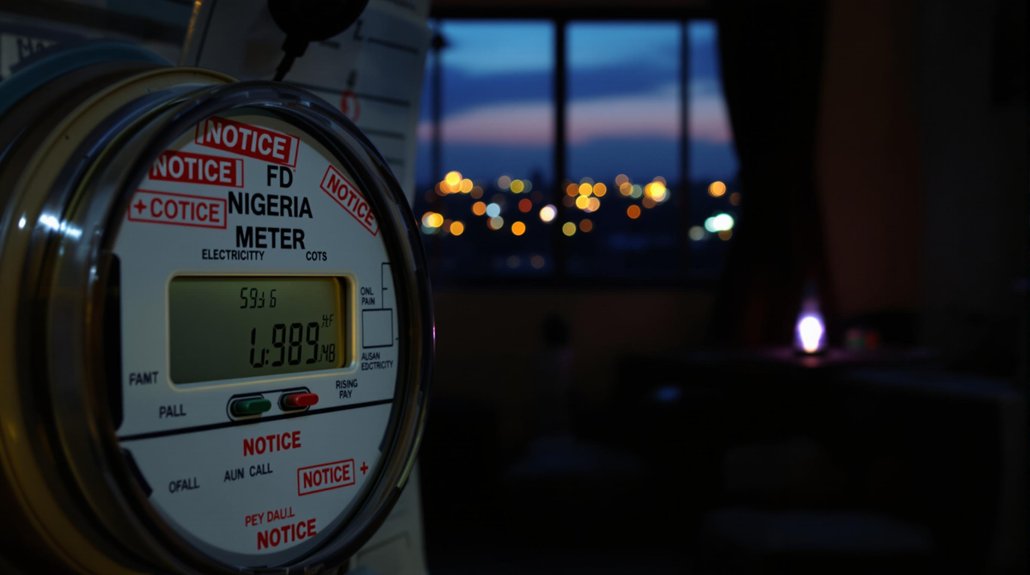

Meanwhile, regular folks just want affordable electricity. Whether caused by secret Wall Street cabals or plain old market forces, those bills aren’t getting any smaller.

References

- https://www.esgdive.com/news/blackrock-vanguard-state-street-seek-dismissal-red-states-coal-antitrust-texas/743232/

- https://www.texasattorneygeneral.gov/news/releases/attorney-general-ken-paxton-sues-blackrock-state-street-and-vanguard-illegally-conspiring-manipulate

- https://www.realclearmarkets.com/articles/2025/07/01/coals_decline_isnt_a_conspiracy_its_a_market_signal_1119455.html

- https://www.justice.gov/opa/pr/justice-department-and-federal-trade-commission-file-statement-interest-anticompetitive-uses