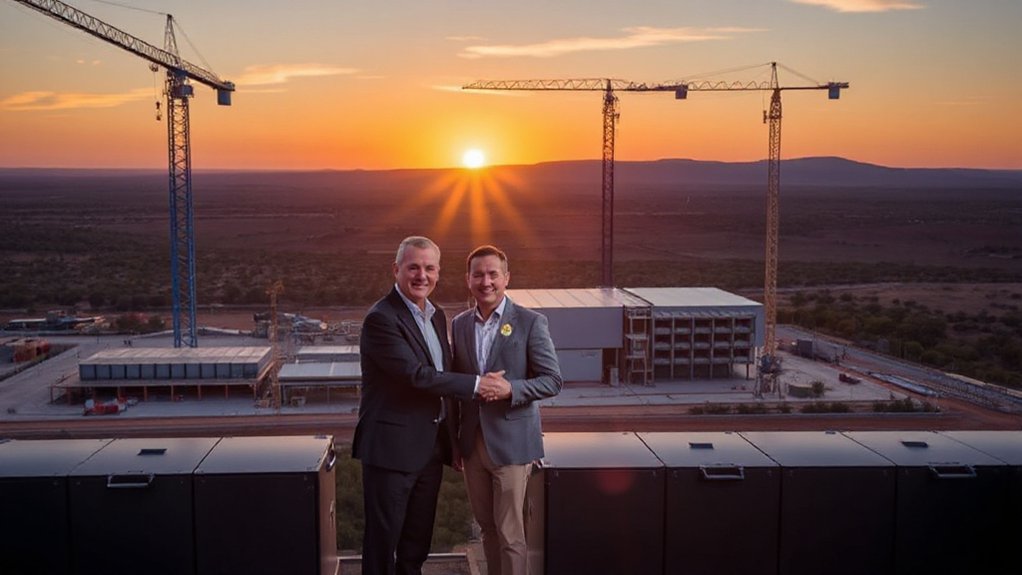

InCommodities is betting big on Australia’s energy future, plunging over $300 million into a 15-year battery storage capacity swap agreement with Ampyr. The Danish energy trader’s first long-term Australian investment targets up to 120 MW of storage capacity at the Bulabul Battery Energy Storage System near Wellington, NSW. Bold move? Absolutely. Risky? We’ll see.

Denmark’s InCommodities gambles $300M on Australian battery storage—their biggest overseas wager yet.

The massive project isn’t exactly small potatoes. Bulabul—a Wiradjuri word meaning “two acting together”—consists of two ambitious stages. Bulabul 1 brings 300 MW / 600 MWh online by 2027, while Bulabul 2 adds another 100 MW / 400 MWh. Construction on the first stage is already underway.

When completed, this beast could power around 300,000 households—for about two hours. Not exactly solving the energy crisis, but it’s something.

Ampyr didn’t just secure InCommodities‘ millions. They locked down AU$340 million (roughly US$221 million) in debt financing from major banks, with Singapore-based AGP Sustainable Real Assets backing the play. Money’s flowing like electricity through transmission lines.

What makes this project genuinely interesting isn’t just its size. The local Wiradjuri Aboriginal community, represented by Wambal Bila, holds a 5% equity stake—without pre-existing native title rights. That’s a first. This arrangement could generate $20-30 million over 25 years for the community. Not bad for showing up to the negotiating table.

Fluence, a battery storage system integrator, got the contract to build Bulabul 1 after Ampyr purchased half the project site from Shell Energy Australia. The second stage remains fully Ampyr-owned, with construction starting mid-2026. The partnership with Fluence includes their advanced AI-powered bidding optimization software to maximize the battery’s market performance. The project is strategically positioned in the Central West Orana renewable energy zone, maximizing its grid impact. This initiative aligns with global efforts to address energy storage challenges that often limit weather-dependent renewable sources like solar and wind.

The partnership claims it’s all about enhancing market competition, investment security, and innovation in large-scale electricity storage. Fancy words for a gamble on Australia’s renewable energy future.

Whether this massive battery investment pays off or fizzles out like a cheap power bank remains to be seen. But with $300 million on the line, InCommodities clearly isn’t afraid to shock the market.

References

- https://www.pv-magazine-australia.com/2025/11/27/ampyr-inks-300-million-long-term-agreement-for-bulabul-bess/

- https://www.energy-storage.news/ampyr-australia-starts-construction-on-600mwh-bess-in-new-south-wales/

- https://www.sharecafe.com.au/2025/11/27/ampyr-australia-signs-landmark-battery-deal/

- https://www.firstnationscleanenergy.org.au/wellington_aboriginal_community_secures_commercial_partnership_equity_ownership_in_major_battery_project_nit

- https://reneweconomy.com.au/this-is-the-energy-future-eight-hour-battery-gets-new-owner-and-new-location-at-site-of-states-last-coal-plant/

- https://openelectricity.org.au/analysis/open-electricity-dispatch–august-2025

- https://ntacl.icn.org.au/project/15217/wellington-battery-energy-storage-system-bess?st=projects&rl=eyJ0aXRsZSI6IkJhY2sgdG8gc2VhcmNoIHJlc3VsdHMiLCJ1cmwiOiJcL3Byb2plY3RcL3NlYXJjaFwvNjg3NjVmNjNiYTlhZSJ9

- https://econews.com.au/ampyr-australia-and-incommodities-sign-15-year-battery-storage-agreement-for-the-bulabul-bess-project/

- https://www.futuregridsummit.com.au/article-medium-duration-batteries-are-entering-their-breakout-moment