President Biden’s $3 billion battery initiative has created 12,000 jobs across 14 states and tripled EV sales. The program generated $16 billion for manufacturing while developing domestic battery materials production. Trump’s return threatens this progress as he’s pledged to eliminate the Inflation Reduction Act that provides $110 billion for battery development. This shift could halt America’s clean energy momentum and surrender technological leadership to global competitors.

President Biden’s ambitious plan to boost American battery production now faces an uncertain future following Donald Trump’s election victory. The Biden administration has invested $3 billion in 25 battery projects across 14 states, creating over 12,000 jobs and generating $16 billion in total investment for manufacturing and recycling.

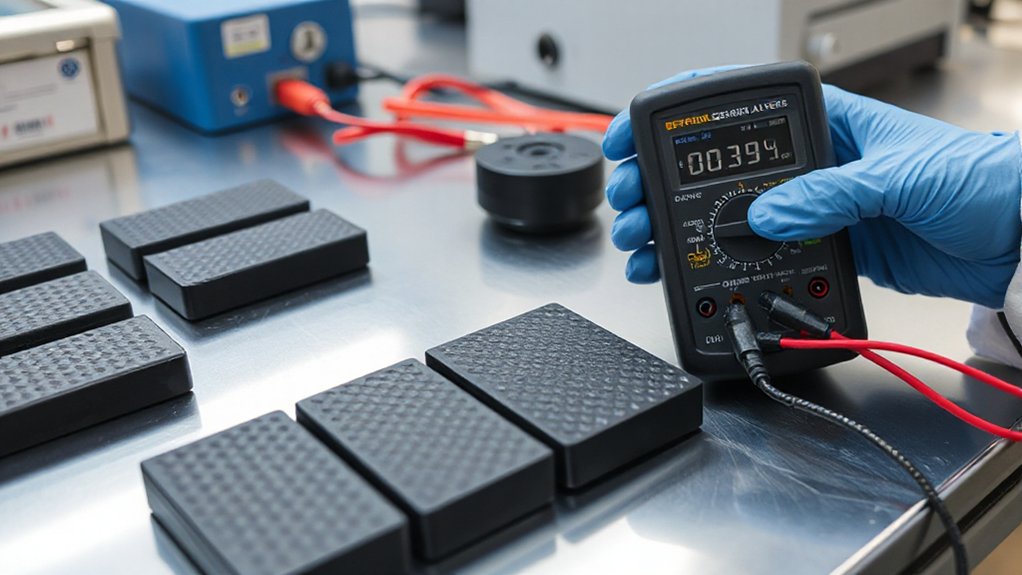

These initiatives aim to develop domestic production of battery materials including lithium for 2 million electric vehicles annually, graphite for 1.2 million EVs, and nickel for 400,000 EVs. The plans also include building America’s first large-scale LiPF6 production facility and an electrode binder facility to meet 45% of anticipated 2030 demand.

Ambitious battery initiatives will build domestic supply chains, reducing America’s dependence on foreign materials for our electric future.

Under Biden’s leadership, EV sales tripled, with $100 billion in investments announced for EV manufacturing, batteries, and charging infrastructure. The administration set a goal that half of new vehicles sold by 2030 would be electric, backed by $135 billion in funding across multiple acts and tax credits to make EVs more affordable. This transition aligns with global efforts to reduce carbon footprint while creating sustainable transportation solutions.

The American Battery Materials Initiative was established to secure reliable mineral supplies and align federal resources for battery supply chain growth. This effort addresses U.S. dependence on foreign critical minerals by supporting faster permitting for domestic projects.

Major loan programs have boosted EV infrastructure, including $9.63 billion to BlueOval SK for battery plants creating 7,500 jobs in Tennessee and Kentucky, and $1.25 billion to EVgo for 7,500 DC fast chargers, with many in disadvantaged communities. Nearly 90% of the selected battery manufacturing projects are located near disadvantaged communities, advancing President Biden’s Justice40 Initiative for equitable investment.

State-level programs received significant funding too, with $50 million allocated to five states for auto facility upgrades and $11.5 million for battery recycling across seven states.

However, the Trump administration is has prioritized traditional energy sectors over renewables. Trump has historically emphasized oil and gas development while criticizing EV incentives and climate policies. He has repeatedly pledged to eliminate the IRA, which provided the critical $110 billion in funding for battery industry development.

This shift may halt the momentum Biden built in clean energy investments and domestic battery production, potentially leaving America behind in the global EV transformation.