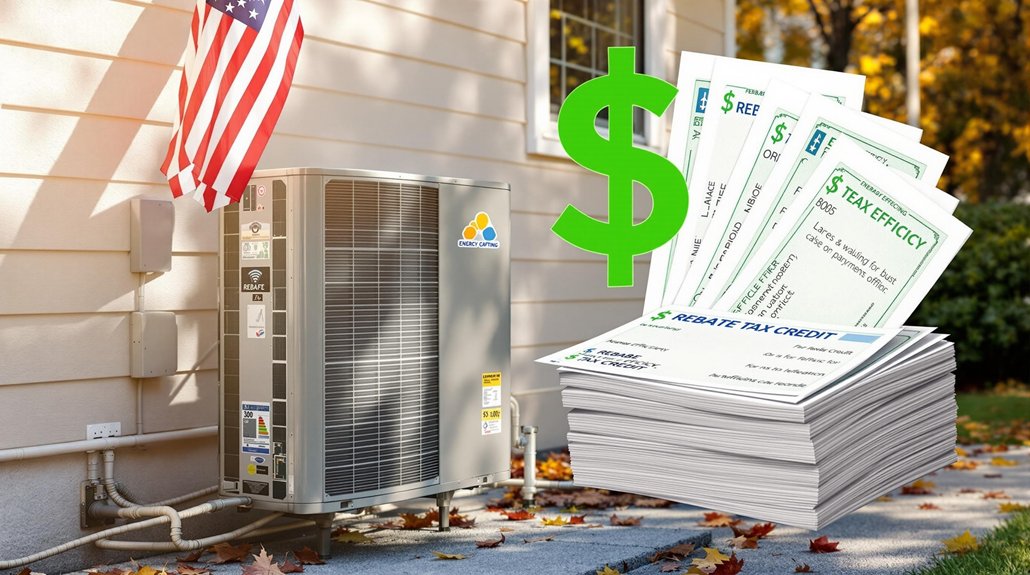

Heat pumps are suddenly affordable, thanks to game-changing federal rebates. Homeowners can snag up to $10,000 through combined incentives—$8,000 from the High-Efficiency Electric Home Rebate Program plus a 30% tax credit up to $2,000. Lower-income households get the sweetest deals. States like Massachusetts and New York pile on additional thousands. With typical systems running $5,000-$20,000 before rebates, many folks break even in just years. The math speaks for itself.

Why struggle to pay full price for a heat pump when the government is practically begging to help cover the costs? A wave of federal and state rebates has transformed the once-pricey heating technology into a surprisingly affordable upgrade for many American homeowners.

The High-Efficiency Electric Home Rebate Program now offers a staggering $8,000 toward heat pump costs. That’s not pocket change. Add in the 30% tax credit up to $2,000 through the Energy Efficient Home Improvement Credit, and suddenly the math gets interesting. Really interesting.

Federal incentives offer up to $10,000 for heat pumps, making the math suddenly very interesting for homeowners.

It gets better for those with modest incomes. Households earning below 150% of their area’s median income qualify for the juiciest rebates. Those with income below 80% of AMI qualify for the most generous full rebates available. Some lucky homeowners could pay absolutely nothing for their shiny new heating system. Zero dollars. Must be nice.

States aren’t letting the feds have all the glory. Massachusetts throws in up to $10,000 for whole-home conversions. New York? Between $5,000 and $10,000. Maine and California aren’t far behind. Stack these with federal incentives, and we’re talking serious money.

The average heat pump system runs between $5,000 and $20,000 before incentives. After rebates, many homeowners break even in just 2-7 years through lower energy bills. These systems deliver exceptional efficiency by producing 3-4 times more energy than they consume. Over a system’s lifetime, that’s $10,000 to $30,000 back in your pocket. Not too shabby.

But it’s not all sunshine and rainbows. Finding qualified installers can be a nightmare. Supply chain problems mean waiting lists. And many homes need electrical upgrades, adding unexpected costs. ENERGY STAR® Tax Credits are providing additional opportunities for homeowners looking to qualify for federal incentives in 2025.

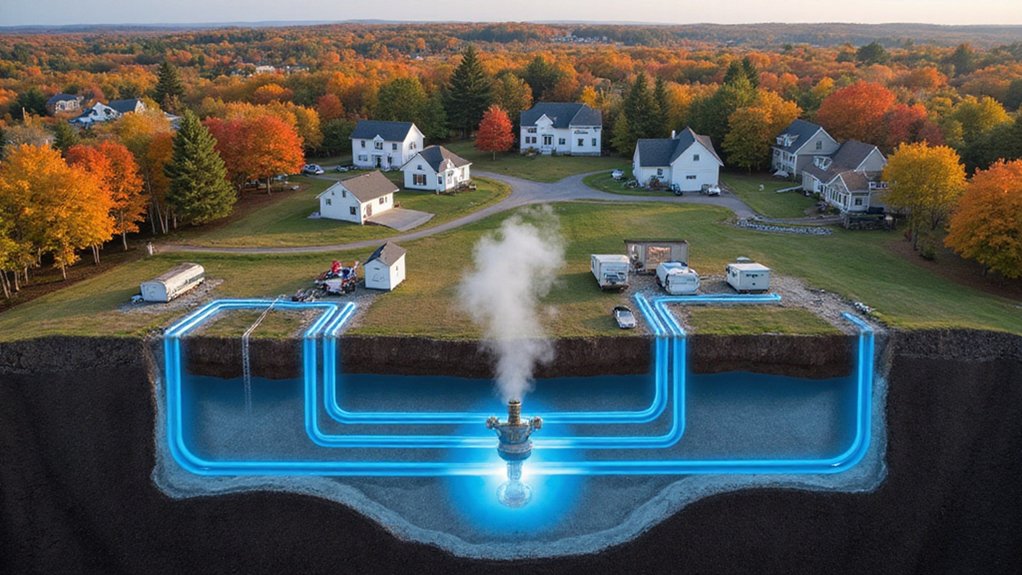

The environmental benefits can’t be ignored. Heat pumps deliver 3-5 times the efficiency of gas furnaces. They slash home heating emissions by 50-70%. No combustion means better indoor air quality. Finally, a climate solution that actually pays you back.

The future looks bright. Expect costs to drop another 20-30% as manufacturing scales up. More states will mandate heat pumps in new construction. For homeowners watching their energy bills climb, these rebates couldn’t come at a better time.