Residential solar storage is exploding. The market’s headed for $60 billion by 2030, growing 40% annually. One in four solar homes now installs batteries too. Why? People are sick of unreliable grids and rising electricity costs. Payback periods of 4-7 years make economic sense, especially with 30% tax credits. Tesla, LG, and Enphase lead the charge while utilities scramble to adapt. The fossil fuel exit isn’t loud—it’s happening in millions of garages.

While power outages and soaring electricity bills plague homeowners nationwide, a quiet revolution brews on rooftops and in garages across America. The global residential solar storage market is exploding, set to hit a staggering $60 billion by 2030. Not just growing—surging at 40% annually. These aren’t just statistics. They’re the death knell for fossil fuel dominance in our homes.

Look around. One in four new solar installations now include battery storage. Why? Because people are sick of depending on outdated grid infrastructure. U.S. residential storage deployments jumped 138% in 2024 alone. By year’s end, over 3 million homes worldwide will have battery systems. That’s millions of mini power plants, ready to flip the middle finger to utility companies during the next blackout.

Revolution in your garage: millions of mini power plants telling utility companies exactly what they can do with their next blackout.

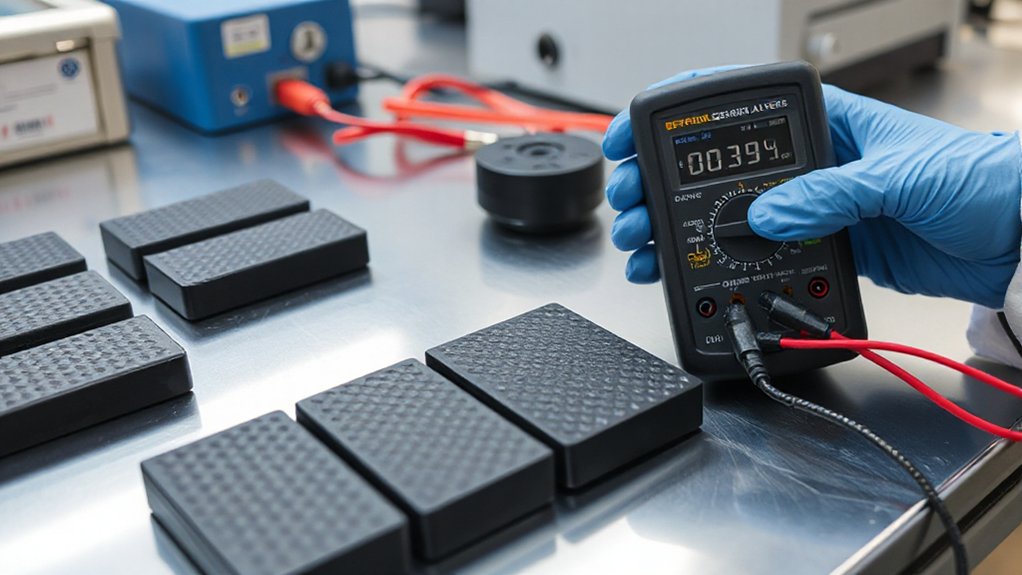

The technology keeps getting better. Lithium iron phosphate batteries dominate today’s market, but solid-state batteries are coming by 2028 with triple the energy density. Oh, and prices? Down 60% since 2015. Battery packs now cost under $100/kWh. Many homeowners are achieving 4–7-year paybacks in top U.S. markets, making the investment increasingly attractive. Do the math—payback periods average just 5-7 years. Federal tax credits covering 30% through 2032 don’t hurt either. The economics make perfect sense as carbon pricing continues to expand across global markets, making fossil fuel alternatives increasingly costly.

This isn’t just about saving a few bucks. These systems are getting smarter, with AI optimizing energy use and enabling homeowners to sell power back to the grid. Artificial Intelligence integration is revolutionizing how smart batteries predict energy demand and manage supply during peak times. Virtual power plants are aggregating thousands of home batteries, creating decentralized energy networks that utility companies never saw coming. They’re scrambling to adapt.

Consumers have multiple reasons to jump on board. Energy independence. Backup during increasingly common outages. Rising electricity rates. Environmental concerns. And honestly, these systems just look better now—sleek, compact designs that don’t scream “industrial eyesore.”

The market leaders—Tesla, LG, Enphase—are racing to keep up with demand while Chinese manufacturers expand globally. Regulatory changes increasingly favor storage adoption. The fossil fuel era in our homes is ending. Not with a bang, but with a quiet, efficient hum from the garage.