The race to power our future just got more interesting. While lithium-ion batteries have dominated headlines for years, several dark horse technologies are quickly gaining ground. Solid-state batteries are leading the charge with their lighter weight and higher energy storage capabilities. No liquid electrolyte means less chance of your car turning into a fireball. Companies like Toyota and QuantumScape aren’t just talking—they’re aiming for mass production by 2026.

Battery revolution underway as solid-state tech promises lighter, safer alternatives to lithium-ion dominance by 2026.

Then there’s lithium-sulfur. Half the cost of current batteries? Yes, please. These batteries ditch expensive materials like cobalt and nickel, making supply chains less of a nightmare. Huawei’s already bragging about their hybrid sulfide polymer with a ridiculous 450 Wh/kg energy density. That’s enough juice for over 2,000 km of range. Not too shabby.

Silicon anodes are another contender. They’re replacing graphite and boosting performance by 40%. Silicon is dirt cheap and everywhere. Pair it with fancy fleece collectors instead of traditional foil, and you’ve got something special. The latest developments in KISS super capacitors demonstrate exceptional durability, retaining nearly 100% capacity after 100,000 charge cycles.

Don’t sleep on sodium-based batteries either. They’re showing up alongside high-temperature lithium variants in market projections. The lead acid segment, closely related to sodium tech, already grabbed a decent chunk of the 2023 market.

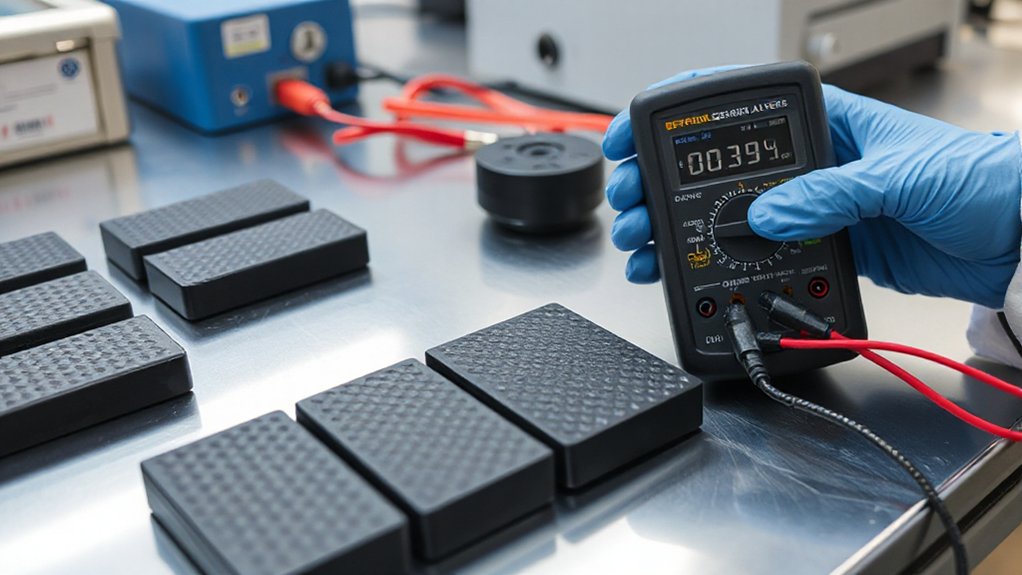

Manufacturing innovations are changing the game too. SONOCHARGE uses acoustic waves to stop lithium plating. Nanoloy’s plasma-printed batteries create stronger molecular bonds. Real sci-fi stuff that actually works.

The numbers don’t lie. The battery market is exploding from $157.4 billion in 2025 to a projected $631.8 billion by 2035. Asia Pacific will dominate with nearly 60% market share, but everyone’s getting in on the action. The region has already secured 53% market share in the global lithium-ion market as of 2024.

Big players aren’t sitting idle. Ultium Cells dropped $2.3 billion on a new lithium-ion plant. China already controls 80% of manufacturing capacity. The battery wars are heating up, and lithium-ion’s monopoly is looking shakier by the day.

References

- https://www.youtube.com/watch?v=_2klfPrAcLQ

- https://www.startus-insights.com/innovators-guide/battery-report/

- https://www.researchnester.com/reports/battery-market/3474

- https://www.gray.com/insights/battery-industry-expected-to-reach-174-billion-by-2026/

- https://www.cognitivemarketresearch.com/emerging-battery-technologies-market-report

- https://pv-magazine-usa.com/2025/12/19/u-s-battery-market-faces-a-make-or-break-year-in-2026/

- https://world.einnews.com/pr_news/887540423/next-generation-advanced-batteries-industry-analysis-market-competition-and-future-outlook

- https://www.idtechex.com/en/research-report/li-ion-battery-market/1132