While European automakers cling to their traditional markets, Chinese electric vehicle manufacturers are storming the continent with unprecedented momentum. The numbers don’t lie. Chinese brands doubled their European market share to 5.9% in May 2025, up from a mere 2.9% the previous year. By October, they claimed 6.8% of all new car sales. That’s not just growth – it’s an invasion.

Look at BYD. Their European sales skyrocketed 206.8% in October 2025 compared to the same month in 2024. They’re outselling Tesla by nearly threefold. Remember when Tesla was the EV darling? Those days are fading fast.

MG, BYD, Jaecoo, Omoda, and Leapmotor now account for 84% of all Chinese brand sales in Europe. MG alone sold 29,400 vehicles in May 2025, beating Fiat in year-to-date registrations. Not bad for a brand most Europeans barely recognized a few years ago.

Meanwhile, European manufacturers are stuck in a bizarre balancing act. They’re developing hybrids AND electric vehicles simultaneously, burning through billions. The Chinese? They’ve gone all-in on EVs. Focus beats fragmentation every time.

Europe’s fragmented EV market isn’t helping either. Different countries, different adoption rates, different incentives. Good luck achieving economies of scale with that mess.

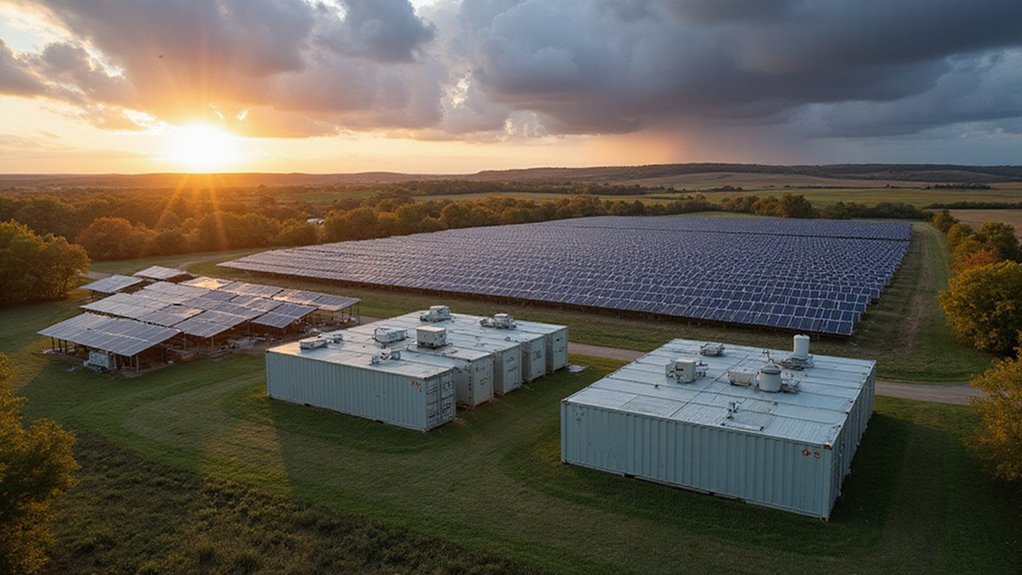

Sure, Volkswagen, Renault, and BMW saw modest growth in May 2025 – 3.3%, 4.6%, and 6.3% respectively. But compared to Chinese brands’ triple-digit growth? They might as well be standing still. The shift to clean energy is inevitable as battery storage costs are anticipated to decrease by 52% by 2030, making EVs even more accessible and affordable for consumers.

The shift toward plug-in hybrids is telling. Chinese brand PHEV registrations jumped from 779 units in August 2024 to 11,064 a year later. They’re adapting faster than European brands can hold meetings about adaptation.

Even with EU tariffs on Chinese EVs, they’re more competitive than ever. The total European market only grew by a 2.5% year-on-year increase in May, while Chinese brands continue their explosive expansion. If European automakers don’t figure out a unified strategy soon, they’ll be fighting for scraps in their own backyard.

The 2035 combustion engine ban was supposed to be their North Star. Without it, they’re just ships drifting toward a Chinese harbor. This imbalance is further exacerbated by China’s control over 75% of the battery value chain, giving their manufacturers an insurmountable advantage in production costs.

References

- https://www.jato.com/resources/media-and-press-releases/chinese-automakers-double-european-market-share-in-may

- https://germanautopreneur.com/p/ev-report-2025-china-europe-usa-market-data

- https://www.best-selling-cars.com/europe/2025-august-europe-car-sales-and-market-analysis/

- https://www.carscoops.com/2025/11/byd-sold-nearly-3-times-as-many-cars-as-tesla-in-europe-in-october/

- https://eleport.com/chinese-evs-in-europe/