Nuclear power is making a comeback with 70 gigawatts of new capacity under construction globally. China leads with half of all new plants, while Russia has added 23 reactors since 2017. However, Western projects face serious hurdles—they’re running eight years behind schedule and 2.5 times over budget. The industry needs $1 trillion in investment and must double annual spending to $120 billion by 2030. These financial realities will determine nuclear’s clean energy future.

While nuclear power is making a comeback around the world, the industry faces significant hurdles in turning ambitious plans into reality. Global nuclear power generation is expected to reach record levels in 2025, with 70 gigawatts of new capacity under construction across more than 15 countries. The renewed interest comes as nations seek solutions to climate change and energy security concerns.

However, the path forward isn’t smooth, especially in Western countries. New nuclear projects in the US and Europe typically run eight years behind schedule and cost 2.5 times more than originally planned. Nuclear’s share in Europe’s electricity mix is declining, expected to fall from 35% in the 1990s to just 15% by 2035. Despite these challenges, nuclear energy provides reliable baseload power critical for grid stability and security.

Western nuclear ambitions face sobering realities: massive delays, ballooning costs, and diminishing market share.

China stands in stark contrast, building half of all commercial nuclear plants currently under construction. Chinese projects often finish on time and within budget. Of the 52 reactors that began operating since 2017, 25 are Chinese designs. Russia remains a significant player in the global nuclear industry, accounting for 23 of these new reactors. At this pace, China will overtake both the US and Europe in nuclear capacity before 2030.

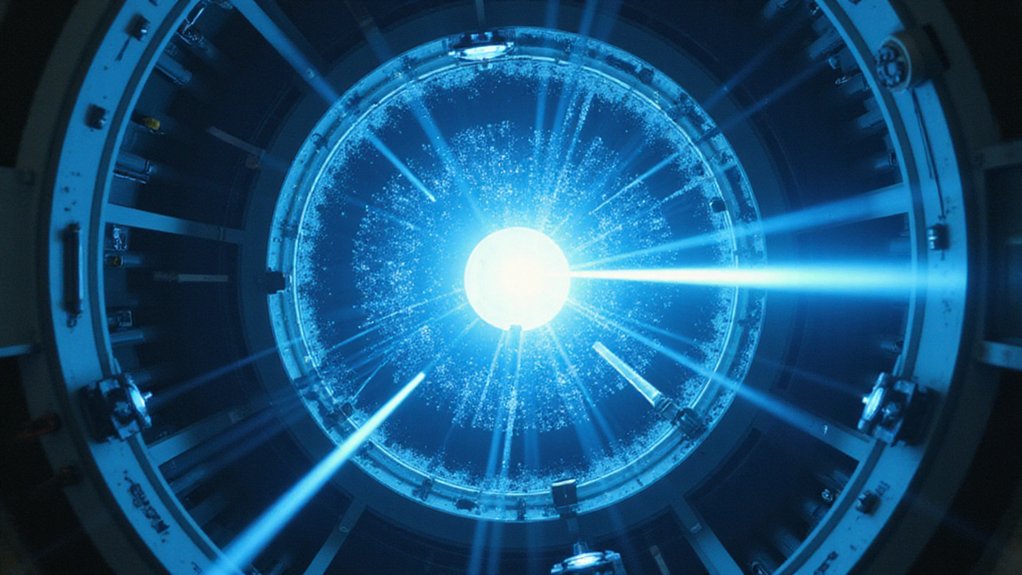

Technology offers potential solutions. Small Modular Reactors (SMRs) promise lower costs and faster construction, but won’t be commercially available until the mid-2030s. Advanced designs with enhanced safety features are also in development, along with promising fusion energy projects.

Financial realities present major challenges. Annual nuclear investment needs to double to $120 billion by 2030, requiring a trillion-dollar commitment over time. Private investors are showing interest, including tech companies seeking power for data centers and AI operations.

Policy support is growing, with bipartisan agreement in the US on nuclear’s importance. However, complex regulations and licensing processes slow progress, especially for new technologies like SMRs.

Nuclear power provides 20% of US electricity and half of its carbon-free power. As electricity demand increases due to AI and decarbonization efforts, the industry must overcome its cost and schedule problems to fulfill its potential in the clean energy evolution.